This online news website is owned and operated by Becky Watts. If you enjoy reading Pike County Times, consider buying an advertisement for your business or sending a donation to support the only free online newspaper in Pike County. Donations can be sent to: The Pike County Times, PO Box 843, Zebulon, Georgia 30295. Click here to donate through PayPal. Thanks for supporting Pike County's only free online newspaper!

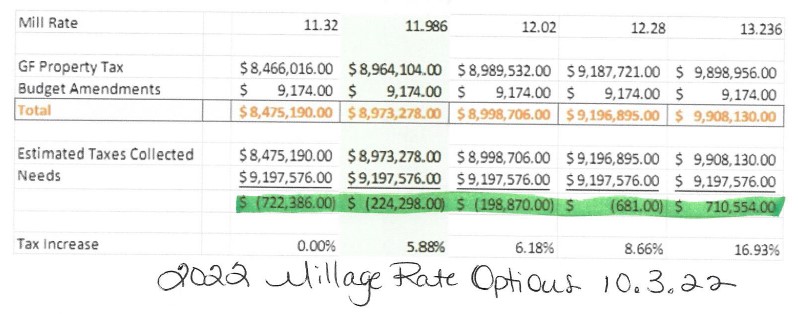

Photo of Proposed Millage Rates Including Estimated and Needed Taxes. Courtesy of the Pike County Board of Commissioners.

ZEBULON - The Pike County Board of Commissioners set the budget earlier this year and recently held public hearings on the proposed 2022 property tax increase. The millage rate would have been set at 13.236 mills which would have been an increase of 16.93% over last year.

Public hearings were held on Wednesday, September 28 at 11:30 a.m. and 6 p.m. and on Wednesday, October 5 at 6 p.m. The vote on the millage rate was made at the 6:30 p.m. meeting held on October 5 directly after the public hearing on the millage rate.

Pike County Times could not attend the final public hearing at 6 p.m. or the meeting held to set the millage rate which occurred at 6:30 p.m. on Wednesday, October 5, 2022 but did sit down to listen to the 45 minute audio recording of the two meetings on the following day.

There were between 40 and 50 people in attendance at the meeting. Not all spoke but this was a good time to be involved in county business. Commissioners listened and did not go with the 16.93% increase.

Budget discussions should be held in April or May of next year, and the public is invited to look at all items included in the county budget. Pike County Times posts a copy of the preliminary budget online and attends as many meetings as possible during that time. It would be nice to commissioners to see members of the public at these meetings reading the budget and asking about budget items.

[Note from the Editor: On a side note, I’ve been attending these hearings about millage rates for a long time and still needed help to understand what was going on. Thank you to Tax Commissioner Donna Chapman for answering my MANY questions, thank you to County Clerk Angela Blount for making my audio and searching for records, and thank you to the commissioners who talked to me about the meeting so I had background to go with the audio and the notes that I obtained. I did not ask for the sheet that had everyone’s name on it so I am only including the names of those that were clear in the meeting. If you would like for me to add your name, please contact me, and I will update this article.]

Additional Information

The county manager sent out an email on Monday, October 3, 2022 that updated everyone on expenses cut, revenues added, possible funding sources, and known budget increases.

Known budget increases include defined benefits of $184,826 which is our retirement system that is helping to retain employees and $46,000 for the net for the baseball field to protect people in other areas of the park from getting hit by baseballs. An expense that could be cut would be $100,000 from Local Maintenance & Improvement Grant (LMIG). This is money that is used for improvements to roads, culverts, etc. in the county. We have been combining LMIG and SPLOST money together to repave roads around the county.

Additional revenue sources include culvert permit fees of $40,000 and permit fees of $100,000.

Other possible funding sources include ARPA Funds which are Covid monies sent to the county that being used for waterlines in needed areas and were earmarked in a previous meeting to help bring broadband to the southern end of the county. This is $1,000,000.

Officials and department heads looked at the budgets and offered to forgo immediate needs, etc. in order to help with this budget crunch. Funding sources within current budgets include $25,000 in contingency, $10,000 in elections, $5,000 in probate, $1,600 in animal control, $15,000 in building and grounds, $400,000 for the Extension Center at Chestnut Oak, and $31,000 from the commission office.

CM Rogers made his recommendation on the which millage rate he would choose in order to get the closest coming out even without having to look for additional funding sources was 12.28 mills which would be an 8.66% increase but would only leave the county with having to find $681 (as in less than $700) in additional funding to cover this budget. He highly recommended against 11.32 mills (which was an actual 0% raise in taxes) because of the $722,386 that would have to be made up from somewhere.

He also laid out the Mill Rate chart that is seen at the top of the page. 11.986 is the same amount as last year but has a tax increase of 5.88%. This leaves the county with a deficit of approximately $224,298 that must be made up from somewhere. This is the amount that a majority of the commissioners chose to go with.

Pike County Times spoke with Tax Commissioner Donna Chapman who advised that there could be some changes to tax bills based on a change in the fair market value of the land owned by the taxpayer from the land based tax assessment recently conducted by the Pike County Tax Assessor’s Office. However, it will be small compared to the recent reassessments of home and commercial properties that have taken place over the past two years. [Note from the Editor: The Tax Assessor’s Office and the Tax Commissioner’s Office are different offices with different jobs, and both are necessary for Pike County government with requirements that are followed from the State of Georgia. Many of these requirements are unfunded mandates, but don’t get me started...]

11.32 mills would be a 0% increase from last year that would have a deficit of $722,386 deficit. That means that the county would have been required to find $722,386 from somewhere to pay for the deficit in order to keep our county running. This is the number that both Commissioner Jenkins and Proctor wanted for the budget. However, it would likely have required at least a portion of ARPA funds that are currently earmarked or hoped to be used in future planning such as water projects and to help bring in broadband for the southern part of our county.

District 3 Commissioner Jason Proctor advised the following when contacted about his vote on the millage rate: “I would like to be clear that I voted NO to increasing the taxes. I wanted the millage rate to go down to 11.32 with 0% increase is why I opposed. Thanks to everyone that came out, texted, or emailed me this week. Your concerns were definitely noted with me.” Commissioner Jenkins echoed this sentiment when he was contacted. [Note from the Editor: Pike County Times contacted all of the commissioners and the county manager to ensure that if anyone had any further comments other than the meeting, that those comments would be added.]

Going with 12.02 mills would have had a deficit of $198,870 to find from somewhere as well as a 6.18% increase in taxes.

And the proposed millage rate of 13.236 mills would have been a 16.93% increase which would have raised $710,554.

This background information makes the public hearing and vote on the millage rate a little easier to understand.

The 6 p.m. Public Hearing on the Millage Rate

Chairman Briar Johnson, Commissioners James Jenkins, Jason Proctor, Tim Guy, Tim Daniel, County Clerk Angela Blount, and County Manager (CM) Brandon Rogers were in attendance. County Attorney Rob Morton was not able to attend these two meetings.

Chairman Johnson called the meeting to order, and the Commission approved the agenda for the meeting as follows: “PUBLIC HEARING: To receive public input on the notice of proposed property tax increase.” There was 20 minutes where citizens could speak about the proposed property tax increase. Citizens were directed to speak only to the Commission Chairman, and questions were answered at the end of the public hearing. This may seem strange, but this is normal procedure to ensure that citizen time is given to the citizens to speak without rebuttal taking up citizen time.

Cherry Thomas spoke first and noted that since the second meeting is being held directly after the first, does that mean that this is being adopted no matter what we think? Chairman Johnson advised that the commission was holding the meeting for the adoption of the millage rate as required by law and that this meeting was being held for them to hear input from citizens about the proposed property tax increase. She said, I think that we are all here because we don’t want to see a tax increase. She then said that she thinks that each commissioner’s vote should be governed by what their constituents want, and that if we can’t find people who can cut budgets for the sake of the citizens, then we need to hire a good budget manager who can help them do this. She said that it’s hard time for everyone in our county as well as across the country. She asked the county go back to the drawing board and do something for the citizens. She also said that Wednesday was a bad night to have the meeting because it was a church night. She said that commissioners need to vote for what the citizens want for a change. She said that we (as in the citizens) don’t know what the spending is, we don’t get to review all that stuff, but we all know how to cut our own budgets and somebody up here should cut budgets too.

After Mrs. Thomas concluded, Chairman Johnson said that since this was being recorded, he advised that he did not say what Mrs. Thomas said when she said that the Board wasn’t going to listen. Mrs. Thomas asked if she misunderstood what he said. Chairman Johnson said yes because he doesn’t know what the Board is going to do in the 6:30 p.m. meeting. She apologized and thanked him for clarifying.

Edward Penland spoke next. He said thank you for what you do to the commissioners and the county manager. He said that it’s a thankless job. He said that it’s tough times for everyone and tough times for the county. Expenses are going up for people as well as the county. There are a lot of young families having to make hard decisions at the grocery store, and there are retirees on fixed income doing the same thing with their budgets. It’s easy to look at the numbers while sitting in an office, but he said that they need to think about people in the county who are depending on them with these decisions—especially if property taxes go up. Please vote for no increase. Let’s tighten our belts and ride this out for another year.

Another gentleman (Carden?) asked some questions. He went through Department 13 in the budget first. He asked about group insurance, HRA, defined benefit--is this a retirement?--and noted that the county manager’s insurance increased this year, and that administration insurance increased. He said that the District Attorney’s Office went $127,034 to $189,876. That’s a 49% increase over last year. He said that he would like to understand where some of these increases came from. [Note from the Editor: I would LOVE for someone to come into the budget meetings with me and ask questions like this. My 2022 budget had over 30 tabs on it with questions that I asked department heads, commissioners, and the county manager! Seriously. Come sit with me! Feel free to hit me up during budget season too and look at the links provided even if you can’t attend the meetings. Ask me questions or ask questions of your commissioners too please!] He notes that his taxes keep going up, but he isn’t getting services for those taxes. He doesn’t have any children in school, but he does get his road graded. For a 51% increase, he’d like to see more services. He said that he asked his boss for an increase and his boss said no so he’s asking commissioners the same thing. He asked the county manager if the statement in the Pike County Journal that inflation was the reason for this budget was correct. Chairman Johnson advised that questions would be answered at the end of the public hearing. Mr. Carden then said that the August 2022 Consumer Price Index measuring inflation was 8.3%. He said that this is a 23.37% increase in the budget and questioned the figures. He said that the figures aren’t adding up in his book.

Tricia Gwyn said that she understands that houses will be reassessed again in 2023. She understands from a very good source that those assessments are going to be more substantial—more so than they were in 2020. She asked when the assessments come out next year, will the new millage rate and the substantial new assessments be taken into consideration at that time?

Another gentleman (Bill?) was at the meeting because he doesn’t get enough for his tax dollars from the county already. He gets no county facilities like sewage or water, but that’s fine because he lives on a dirt road and wants to be in a rural county. He said that he would like to be taxed like he lives in a rural county. He is 81 and said this is a hardship on people like him. The taxes were increased last year, and he is protesting this tax increase this year. He said that he gets no fire or police protection that he knows of, and it costs him $2,000 a year just to live in this county. He said that his road and sides of the road aren’t maintained well. And he’s protesting this tax increase because he doesn’t get anything for his taxes.

Another gentleman (Burge?) is a 45 year resident. Said that he’s raised three children who were educated but not through the school system here. Said that the property taxes on one of his buildings doubled when they painted and put windows in it. Said that school taxes are hard to pay with the school tax being almost as much as this tax. It seems like you are taxing older people to the point that people are going to have to sell and move somewhere else.

Emory Pitts is concerned with seniors on fixed incomes in our county and how taxes are affecting them. We have to cut back and budget, and he thinks that it would be good for the county to budget with the taxpayers’ money.

Another gentleman (Jim?) said that we’ve seen a lot of growth in businesses in the area and wonders if projections on increased taxes on businesses will not cover what the proposed millage is going to bring in.

About 15 minutes into the public hearing, no one else wanted to speak so the public hearing portion of the meeting was closed in order for questions to be answered.

Chairman Johnson addressed the question about the commercial property by saying that 91% of our tax base is citizens. Commercial is like 8 or 9%. This is unhealthy according to the UGA Carl Vinson Institute that recommends that we be 65 or 75% citizens and 25 or 35% commercial. We’re a long way from that so to answer the question of whether commercial will make this up, the answer is no. We’re a bedroom community, and we’re trying to bring in businesses. He said that someone said the other night that they businesses don’t pay taxes, but they do.

CM Rogers walked through his notes and said that he’ll be happy to talk to anyone between meetings if they don’t get an answer to their questions.

For Mr. Carden’s(?) questions. Group insurance—that’s part of an increase in insurance from last year to this year. 3 or 4 months ago, we changed to an HRA and that $87,000 is there because the county has to put up the first part of that money for the HRA for employee use. We were going to stick with just an HRA but offered group insurance for employees who did not want to use the HRA insurance. [Note from the Editor: Here is some information to help readers understand this: April 21, 2022 meeting (this includes a copy of the budget at that time), May 26, 2022 meeting, and May 31, 2022 meeting.]

The retirement plan is new and being used as a recruitment and retention tool for the county. He said that our neighboring counties are sucking up our police officers and other workers, and it was really hurting us. He said that we have seen less of a turnover here.

Insurance for the county manager is new as well. He has provided his own insurance for the county for the past 8 years that he has been employed here. [Note from the Editor: He worked for Buildings and Grounds before being appointed the County Manager.] Mr. Carden asked a question from the audience about whether CM Rogers’ salary was adjusted when he began receiving insurance benefits and was advised that his salary was not adjusted.

Insurance for employees in the department with turnover. With turnover, there is a different employee with different needs as far as family, etc. and that is where the increases are.

District Attorney. She added a full-time investigator to her staff. We did not have an investigator here and were sharing one with Upson County.

Mr. Carden clarified what CM Rogers’ quick handwriting said from Carden’s earlier questions. $319,000 was pay increases with the Sheriff’s Office. CM Rogers advised that we were actually at a point where we were so low on employees that we were debating on closing down the jail and sending inmates out to other counties. So, the Sheriff’s Office did some salary adjustments to give a better salary to retain people. That’s the salary increases.

The main reason (for the increase) is the cost of everything. He said that as we go through every line item, there is very little wasteful spending in this. Your department heads and constitutional officers do a very good job of coming to you in the beginning and only asking for what they need to run (their departments). At the last 2 public meetings, he was asked to do some research and will talk about that a little while later.

Mrs. Gwyn asked about housing reassessments. He said that housing reassessments are very frustrating and aggravating to everybody. We do take those into consideration, but because of the rollback rates, etc. it is very hard to calculate those. But we do anticipate that there will be as substantial increase in housing prices next year. Our sales ratio study came back this year, and we like to see a 40% ratio, but it came back at 32% which means that housing in Pike County is accessed at less than what it is supposed to be. It means that individuals are selling their homes at more than what we are assessing them for. That puts the burden on those who do have correctly assessed homes. Compliance matters for funding, grants, etc. [Note from the Editor: The Department of Revenue Property Tax Valuation page advises the following: In Georgia property is required to be assessed at 40% of the fair market value unless otherwise specified by law. (O.C.G.A. 48-5-7). I asked Tax Commissioner Donna Chapman about this yesterday, and she advised that there are penalties that the county incurs with the state if our housing assessment is too low. The county also only collects the percentage of utility funding that houses are assessed at below the state mandated amount of 38% to 40%. We came in at 33.16% which means that the Tax Assessor’s Office will be required to do a housing reassessment next year because inflationary growth from houses sold in our county (read this as houses sold for exorbitant amounts in this current housing bubble) are affecting our Tax Digest. The Tax Assessor’s Office did housing reassessments in 2020, commercial/industrial reassessments in 2021, and property/land value reassessments in 2022. Unfortunately, next year is probably going to hurt all of us.] CM Rogers said that he would not make a guess on the housing market because it is changing so quickly.

Services on a dirt road. CM Rogers told him that he does have police and fire protection. There is a station on Hollonville Road close to him. There are a lot of services that get overlooked in the county and only come around so often like elections, the district attorney, the Tax Assessor’s Office, the Sheriff, the jail, the Coroner, etc. A lot of these services are state mandated. If you want to knock on a door and come in, you can see a lot of this in the Tax Commissioner’s Office, at the Sheriff’s Office, etc. You can go see them. They are open to you.

School taxes. The county has no control over school taxes. The School Board sets their own tax millage rates. There is a vote coming up on a tax exemption for seniors on school taxes on the November ballot.

Seniors and inflation. CM Rogers said that it weighs heavy on his heart that we have to have the money to run that we do. I live here with my family and understand it. It does not come easy to ask for what we have to ask for.

Growth of businesses. The Chairman clarified earlier on this. One of things asked to do is reevaluate income, revenue, expenditures. Income on LOST has some additional funding so he foresees that being a part of this. It won’t be what it was when it was first predicted because we’ve found some places to cut some funding and get this as low as we could. He said that he would be happy to explain things.

Chairman Johnson added some things for general information. I wish we could get this many people at every single county commission meeting. Sometimes there are only 3 people including the media. We need as many people as possible at our meetings.

It was said earlier that nobody can see our budget and what we’re spending… yes, you can. When we approved this budget 3 months ago, there were two public hearings and the budget was on the county website. We had copies of it here so people could see it when we approved it at the end of June.

Defined benefits. We did start a paid fire department. We’ve never had that. We are starting small. The ambulance contract doubled this year. Not excuses but reasons. We went from $400,000 a year to $800,000 a year. And fuel has affected everyone. We’re not the enemy here. We live in the county, and this affects us too. And the county manager and his staff did a fabulous job of going back and doing his homework. County officials and departments did this too.

Motion to adjourn this meeting and go directly into the next meeting without a long break. Approved 5-0.

Public Hearing was adjourned.

The 6:30 p.m. Millage Rate Special Called Meeting

This meeting began a little late because the Chairman and County Manager took the time to answer the questions that were asked by the citizens in the public hearing. The Chairman said that this was necessary and the other commissioners agreed. [Note from the Editor: Kudos to all for taking the time to do this. That’s how it should be done, and it was done well.]

The 6:30 meeting was called to: “Consider Resolution to Adopt the Fiscal Year 2022-2023 Pike County Tax Levy.”

Commissioner Tim Daniel said that we’re here tonight to set the millage rate. And we’re still going to have a little shortfall, but Brandon (CM Rogers) feels confident that we can find a way to make this work. He then made a motion to leave the millage rate the exact same as it is currently – the same as last year – which is 11.986. Commissioner Tim Guy have the second.

Discussion: CM Rogers asked to talk a little about what Commissioner Daniel mentioned. He said that the Board asked him to find additional funding and cut as much as they could at the last meeting. We had a department head who had $1,600 in her budget for her rabies vaccination but said that she can put that off one more year where departments like this are scrapping for every single dollar needed to run their department. [Note from the Editor: This is Animal Control Officer Tanya Perkins who heads up the Animal Control Department. She is required by the state to have rabies shots on a regular schedule in case she comes in contact with a rabid animal. Her budget is tight, and she STILL tried to help the county on this!]

We found some additional revenues that we had overlooked and are a help. [Note from the Editor: All of these are listed in the section above this.]

He predicts that there will be a shortfall of about $224,000 or $225,000 this year with the 11.986%.

He said that there are some fundings that will help make up the deficit and the county will be looking throughout the rest of the year to cut back as much as they can. This is a sustainable number.

He added though that the best thing for the county if you want to continue offering services as we are now, he recommends of staying at a minimum of 12.28% but he completely understands if the Board decides to stay with 11.986%.

He said that he hoped that he has explained everything well in his phone calls to commissioners.

Chairman Johnson gave further clarification on the department head who offered $1,600 for her vaccination by saying that $1,600 was a lot of money for her. That is a drop in the money for what we need, but it’s a LOT of money to her and her budget. [Note from the Editor: His emphasis, not mine.] He said that other departments offered too, but that stuck in his mind when he heard that because that may as well have been $10,000 in her budget.

Question from the audience about the final number whether it stays the same or goes up.

CM Rogers said that the millage rate will remain the same as last year and that unless there is an actual change in your actual property value there will be no increase but overall will show as a 5.88% increase. He said that we will actually collect more on new houses coming in.

Take your house last year if it appraised for $200,000 at 11.986%. If it appraises for the exact same amount this year, the 11.986% is what you will get. If it appraises for more, it will change. And we do anticipate that there are going to be some changes. Overall, the county will see an increase of about 5.88% in revenues coming in. Most from new housing or changes in appraisal values.

Motion of 11.986% is approved 3-2 with Johnson, Daniel, and Guy in favor and Jenkins and Proctor opposed. [Note from the Editor: No reason was given in the meeting, but Pike County Times did some digging today and approached all of the commissioners and the county manager for any clarification or reasons that they wanted to give on this as are listed in the section above this.]

Item B. Consider authorization for the Chairman to sign the Resolution to adopt the Fiscal Year 2022-2023 Pike County Tax Levy.

Motion for the Chairman to sign the resolution. Approved 5-0.

The Chairman thanked the county manager for his work as the chief financial officer of the county. He extended his thanks to officials and department heads as well.

Motion to adjourn. Approved 5-0. 6:52 p.m.

Closing

Pike County Times Owner and Editor Becky Watts has been attending Pike County Commission meetings for 22 years and publicizing meetings through Pike County Times since 2006.

Hopefully some of that knowledge and the relationships that have been made in that which gave added insight into this article have been helpful to readers as you read in depth about the meeting as well as the work that has been done outside of these meetings to handle our county finances.

[Note from the Editor: If you have any questions, feel free to contact me using the information listed at the top of the home page. This is and always has been a calling for me and is provided as a service to the community. On a side note, there is about 8 hours in this article.]

Thank you to First Bank of Pike for sponsoring Pike County Times’ Breaking News Alerts! First Bank of Pike has been serving customers in Pike County and the surrounding area since 1901 and offers Personal and Business banking with a personal touch. Services include checking, savings, money market, certificates of deposit, and IRA’s. Mobile Banking and Bill Payment services are also available! Click here for more. Please let First Bank of Pike know that you appreciate their sponsorship of Breaking News Alerts on Pike County's only FREE online newspaper!

INFORMATION ABOUT RECEIVING BREAKING NEWS ALERTS CAN BE FOUND, HERE.

Thanks for reading and supporting Pike County Times.com!