Editor Becky Watts: Phone # 770-468-7583 editor(@)pikecountytimes.com

This online news website is owned and operated by Becky Watts. If you enjoy reading Pike County Times, consider buying an advertisement for your business or sending a donation to support the only free online newspaper in Pike County.

Donations can be sent to: The Pike County Times, PO Box 843, Zebulon, Georgia 30295. You can also donate through www.venmo.com/u/pikecountytimes, $pikecountytimes, and PayPal.Me/PikeCountyTimesLLC.

Thanks for supporting Pike County's only free online newspaper!

By Editor Becky Watts

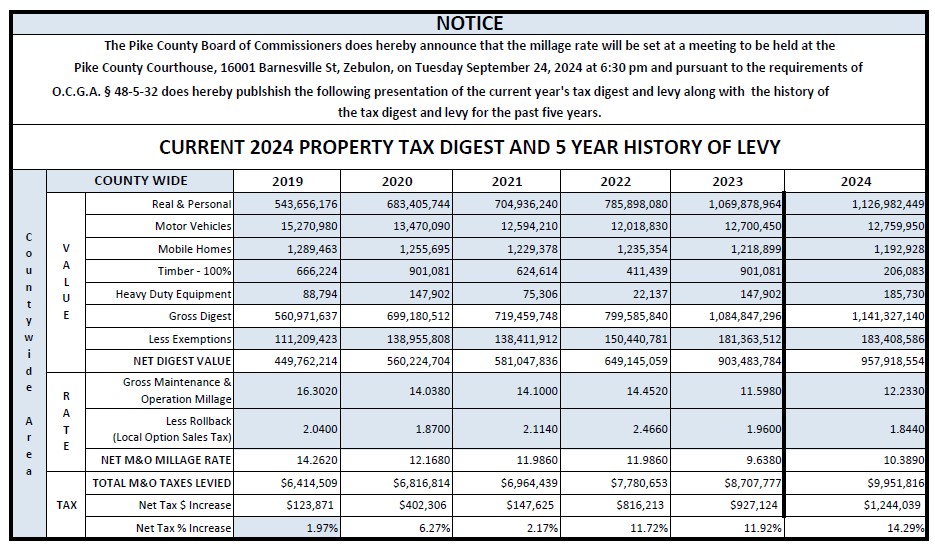

ZEBULON - The Pike County Commission voted 3-2 to increase the 2024 property taxes by 7.78% over the rollback millage rate. There will be three public hearings on this tax increase that will be held in September where citizens can speak to commissioners about this increase.

The vote was held at the county commission meeting on Tuesday, August 27, 2024. The discussion was lengthy and involved four possible options for commissioners to choose to work with.

The Four Options

The first option was to go with the rollback rate of 9.639% which would put the county in shortfall of about $570,000.

The second option was to add .685 mills to the rollback rate which would add $570,000 to fund the Fiscal Year Budget at 10.324%.

The third option was to add .75 mills to the rollback rate which would add $625,000 over last year’s taxes and leave the county with a cushion of $55,000 after taxes are collected. ($625,000-$570,000)

The fourth option was to add 1 mill to the rollback rate which would add $833,000 over last year’s taxes and leave the county with a cushion of $263,000 after taxes are collected. It was noted in the meeting that the county is already pulling from its fund balance in the current budget. ($833,000-$570,000)

How would this affect property taxes? Option 3 would result at an $80 increase in taxes on a $300,000 home. Option 4 would result in a $120 increase in taxes for a $300,000 home. [Note from the Editor: Emphasis is mine to encourage readers to remember these numbers after reading the article.]

The Discussion

Interim County Manager/County Attorney Rob Morton noted in the commission meeting that ARPA funds cannot be used to pay debt service as was previously planned. It was also noted that the school sets its own millage rate on their funding, and that has nothing to do with the county.

It was also noted that if the county did not consider an increase, it could run out of fund balance and not have enough funds to cover payroll for its employees.

Finance Director Clint Chastain answered questions about the county’s finances. He advised commissioners that the county is in a hole with the budget with cash flows on a monthly basis if we go with option 1 and stated that the county will be in the exact same position that it is in this year if it goes with option 1. “Where we are at is not a good place,” he said.

Discussion included looking for places to pull funds from that could possibly change this decision on the millage rate at a later date. Commissioner James Jenkins praised Chastain saying that Chastain has done his homework on this and has done a good job.

It was noted that some things will have to be cut unless we can find some money and that commissioners are concerned about rolling backwards. All of the commissioners expressed concerns about raising taxes.

The Votes

The first vote was a motion to go with option 2 which would have added .685 mills to the rollback rate. This would increase taxes overall by $570,000 to fund the Fiscal Year Budget at 10.324%. Commissioners Tim Daniel made the motion with a second from Commissioner Tim Guy. The motion failed in a 2-3 vote with Commissioners James Jenkins, Jason Proctor, and Chairman Briar Johnson opposed.

The second vote was a motion to go with option 1 which would have put the county in the position of cutting the budget, finding funding of $570,000 to fund expenses, or going in the hole with this year’s budget at $570,000. Jenkins made the motion and Proctor made the second. The motion failed in a 2-3 vote with Proctor and Jenkins in favor and Daniel, Guy, and Johnson opposed.

The commissioners continued their discussion of funding. Option 2 is floating above the surface and may not cover what we have. Option 1 is going backwards unless we find money somewhere. ARPA funds will be used for reassessments and in next year’s budget.

Proctor is hoping that there is money somewhere. Jenkins said that Chastain has done his homework on this and has done a good job.

Even though the commissioners were in agreement that some things would have to be cut unless the county could find some money and a concern was expressed about rolling backwards, it was said that no one was willing to budge on this because the commissioners were concerned with raising taxes.

The final motion was a motion to go with option 3 which would add .75 mills which would add $625,000 over last year’s taxes and leave the county with a cushion of $55,000 after taxes are collected. Guy made the motion with Daniel giving the second for discussion.

The discussion was that the county needs to find some money and use it. And it was noted that there is still an option to change this proposed millage rate at a later date after further review. This passed in 3-2 vote with Guy, Daniel, and Johnson voting with Jenkins and Proctor opposed.

The Press Release

The following was released to the press and the community on August 28, 2024 by the Pike County Board of Commissioners.

PRESS RELEASE ANNOUNCING A PROPOSED PROPERTY TAX INCREASE

The Pike County Board of Commissioners today announces its intentions to increase the 2024 property taxes it will levy this year by 7.78 percent over the rollback millage rate.

Each year, the board of tax assessors is required to review the assessed value for property tax purposes of taxable property in the county. When the trend of prices on properties that have recently sold in the county indicate there has been an increase in the fair market value of any specific property, the board of tax assessors is required by law to re-determine the value of such property and adjust the assessment. This is called a reassessment.

When the total digest of taxable property is prepared, Georgia law requires a rollback millage rate be computed that will produce the same total revenue on the current year’s digest that last year’s millage rate would have produced had no reassessment occurred.

The budget tentatively adopted by the Pike County Board of Commissioners requires a millage rate higher than the rollback millage rate; therefore, before the Pike County Board of Commissions may finalize the tentative budget and set a final millage rate, Georgia law requires three public hearings to be held to allow the public an opportunity to express their opinions on the increase.

All concerned citizens are invited to the public hearings on this tax increase to be held at the Pike County Courthouse, 16001 Barnesville St, Zebulon, GA, on September 11, 2024 at 9:00 am and 11:00 am and on September 24, 2024 at 6:00 pm.

Closing

If all goes according to this schedule, tax bills will be mailed out around the second week of October. This means that Pike County will be back to its regular schedule of tax bills being due by December 20, 2024.

Please note that there was a Property Tax Relief Grant on 2023 taxes that will NOT be on the 2024 taxes. That Homestead Tax Relief Grant gave Pike County property owners a break of $450 on taxes last year. It was a one time grant to homeowners that ended after the 2023 tax year. Read more about it at: dor.georgia.gov/2023-property-tax-relief-grant

So taxpayers should anticipate their tax payment to be a little higher than last year with the full amount being on their tax bills regardless of how the hearings and final vote on the millage rate goes.

The Georgia Department of Revenue has the millage rates for each taxing jurisdiction from 2019 through 2023 online at https://dor.georgia.gov/local-government-services/digest-compliance/property-tax-millage-rates.

Thank you to First Bank of Pike for sponsoring Pike County Times’ Breaking News Alerts! First Bank of Pike has been serving customers in Pike County and the surrounding area since 1901 and offers Personal and Business banking with a personal touch. Services include checking, savings, money market, certificates of deposit, and IRA’s. Mobile Banking and Bill Payment services are also available! Click here for more. Please let First Bank of Pike know that you appreciate their sponsorship of Breaking News Alerts on Pike County's only FREE online newspaper!

INFORMATION ABOUT RECEIVING BREAKING NEWS ALERTS CAN BE FOUND, HERE.

Thanks for reading and supporting Pike County Times.com!